Fund Managers

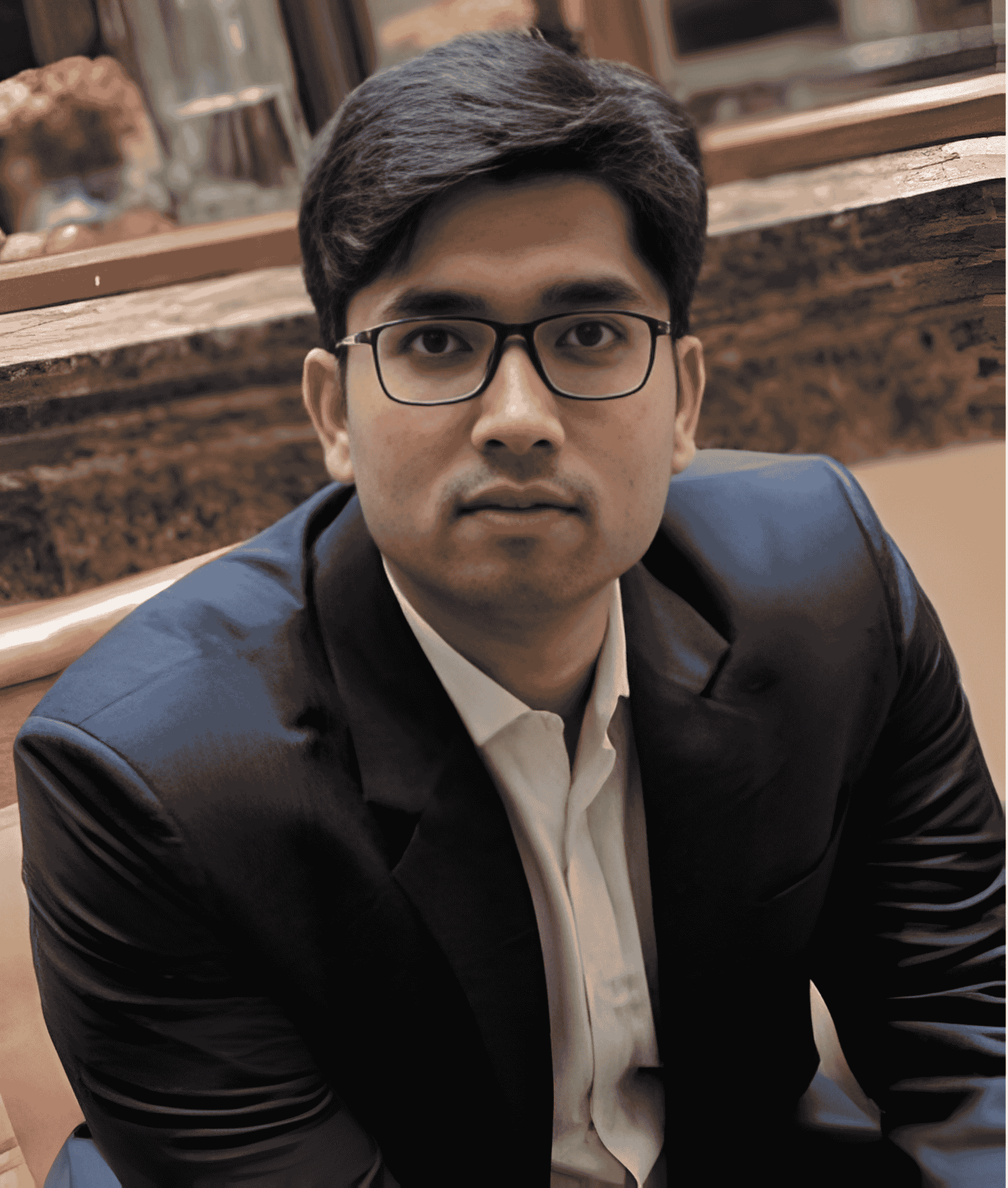

Discover all of the fund managersMayank Mundhra

Mayank conceptualized and set up the Enterprise Risk Management desk at Abans based on his experience of over 11 years at industry leading firms. Having played multiple roles in risk management, credit research, and predictive modeling, Mayank believes that effective risk management is the most fundamental business enabler. An undergraduate degree holder in engineering, Mayank is also armed with a postgraduate degree in Finance from the Mumbai University.

Mayur Agarwal

Over 13 years experience with 11+ years in private management. BCA from BIT Mesra and MBA (Finance) from IBS Hyderabad. Holds FRM Charter (GARP). CFA (US) lvel 3 candidate

Mayur Parkeria

Part of team since June 2001 Working with Wealth Managers since December 2003 Articles with Kirtane & Pandit Chartered Accountants; Pune; M.Com (Pune University) Associate Chartered Accountant CFPCM (Certified Financial Planner)

Mayur Shah

Mr. Mayur Shah is Fund Manager for PMSs run at Anand Rathi, he has done post graduation in MBA Finance and CFP. He has more than 15 years of rich experience in Investment advisory, Product Development and Portfolio Management. He had Started Career with Kotak Securities Ltd in 2005 as an Investment Advisor subsequently got into developing Equity products and running the same. From last 13 years he is part of Anand Rathi group and worked across Portfolio Management and Private Client Group Equity Advisory. Recently, the MNC fund being managed by him has been featured in top 3 pms based on 1 year performance in economic times.

Mehul Jani

Mehul has over 17 years of experience in covering and managing financial services and consumer stocks. Prior to working with IIFL, he worked with DSP BlackRock (a joint venture between BlackRock and the DSP Group in India) for 10 years as an analyst and fund manager. Previously, he spent 4 years at Morgan Stanley Plc in London as an analyst, dealing with structured product valuation and fund derivatives. Mehul is an alumnus of the Cass Business School, London and holds a Masters in Banking and International Finance. He is also a CFA charter holder.

Milind Karmarkar

Dalal & Broacha's research department, comprising a team of six, was set up by this Chartered Accountant. He joined the firm over fifteen years ago after having spent a few years in corporate planning and financial management.

Miten Lathia

A Chartered Accountant, Chartered Financial Analyst ®, Financial Risk Manager, Miten has 8 years of fund management experience in his 20+ years of working in the equity markets. Miten managed the HDFC Capital Builder Value Fund from May-12 to May-20. During this period, the fund beat its benchmark in 6 out of the 8 fiscal years. Before working at HDFC Asset Management, Miten was an analyst at broking houses – Brics, SSKI, Enam and Anand Rathi.

Mitesh Dalal

Mitesh has been associated with Standard Charted Securities India (SCSI) for +12 years and has more than 25 years of total experience in Indian equity markets. Mitesh heads the Investment Strategy team in SCSI. Within SCSI, Mitesh has multi-dimensional experience in Investment Strategy along managing Private Customer Group (PCG) and NDPMS. His past experience in HDFC Securities, SMIFS securities and CDSL protrays a proven track record in various areas of business, marketing, back office, proprietary trading (derivatives), depository services and latest being Equity Strategy. Mitesh is a commerce graduate and has done masters in financial management.

Mitul Patel

Mitul Patel is the Senior EVP of Fund Management at 360 ONE Asset, earlier known as IIFL Asset Management. He brings 19 years of experience in Indian financial services, including the buy-side in fund management, equity research and portfolio management.During his first stint at 360 ONE Asset, he managed PMS funds and several listed AIFs. He was also Head of Research, responsible for generating investment ideas across sectors and market capitalizations.Prior to re-joining 360 ONE Asset, he headed the listed PMS & AlF business at HDFC Asset Management, where he managed more than USD 400 million in AUM. He was also part of the investment committee of their category II AlFs (Fund of Funds) on the private equity / VC side.Mitul was one of the founding members of Laburnum Capital, a Delhi-based investment firm where he spent seven years. Prior to Laburnum, Mitul was an investment banker with J. P. Morgan and Avendus Capital, where he executed M&A and PE transactions as an analyst.Mitul has an undergraduate degree in Business with a focus on Management Information Systems and Operations Management in the US

MOHIT BERIWALA

Mohit is the Founder of SRM. He is an FRM, CFA & IIM-B alumnus. Since 2006, he has been helping Entrepreneurs & Professionals safeguard their assets and reach the goal they desire. Mohit is an FRM, CFA & IIMB Alumnus He has been active in the financial market since he was merely 19 years of age. Since 2006, Mohit has been running a prominent wealth advisory business and has been helping Entrepreneurs and Professionals safeguard their assets and reach the goal they desire.

Mohit Khanna

Mohit Khanna has been associated with the equity markets for nearly 14 years. He has covered multiple sectors as an equity analyst and has been part of the strategic fund

Mohit Nigam

Mr. Mohit Nigam has professional experience and thorough knowledge across markets in Equities, Forex and Bonds. Before heading PMS in Hem Securities Ltd, he has worked with Axis Bank (Treasury) for managing SLR portfolio of the bank. He has also contributed in hedging strategies of the bank. Earlier to Axis Bank, he was a part of Forex Trading India Group (Treasury) wherein he provided mid and large corporate advisory services. Speaking of academics, he is a Chartered Accountant (AIR-42) and a Company Secretary (AIR-23). He also holds a management degree from Indian Institute of Foreign Trade, Delhi.

MR HEMANT C SHAH

Mr. Hemant Shah is the Principal officer and Fund Manager of Seven Islands. He is a strong believer in the philosophy – “Knowledge Protects, Courage Pays”. He is responsible for drawing out the investment strategy of the PMS. In over 30 years of his experience in the financial markets, he has worked with various established investment managers in setting up numerous research desks.

Mr Paramjeet Singh

A Post-Graduation Diploma in Business Administration (PGDBA) Finance. He has extensive experience of more than 30 years in MNC Banks, Indian Banks, and Multi-Family Office Wealth Setups: Axis Bank, HDFC Bank, BNP Paribas.

Mr SANJAY PAREKH

SanjayHParekh(BachelorofCommerce,CharteredAccountant–PassedinMay1994)has27yearsofresearchexperience,ofwhichfirsttenyearswereinresearchacrosssectors–Oil&Gas,Cement,Petrochemicals,Banking,InformationTechnologyServices,Media.Later17yearshasbeeninFundsManagementinEquities–ASKInvestmentManagers(HeadofInvestment–2005to2008),ICICIPrudentialMutualFund(SeniorFundManager–2008-2012),NipponIndiaMutualFund(SeniorFundManager–February 2012 to 9th Sep 2021). InNipponIndiaMutualFund,managedNipponIndiaEquityHybridFund[EquityComponent]withanAUMofRs.3700 Cr. Nippon Tax Fund with an AUM of Rs.11600 Cr Nippon India Banking Fund with an AUM of Rs.2200 Cr Also, Co-Managed an Advisory Mandate with the Kuwait Investment Authority with an AUM of Rs.5700 Cr. AsaSeniorFundManageratICICIPrudentialMutualFundwasmanagingapproximately$1bnacross6oftheKeyEquitySchemes[Oct2008-March2012).TheschemesmanagedwereICICIPrudentialDynamicScheme(forayearwhentheygotmergedwithFusion1/2/3Funds),Top100,Top200,BankingFund,ServicesFundand Target return Fund. HeadofInvestmentatASKInvestmentManagers-PMS(2005-2008).WasheadingteamofPortfolioManagersandResearchAnalystsreportingtoMr.BharatShah.Theroleinvolvedmanagingtheflagshipproduct-GrowthandalsoheadingtheResearchandInstrumentalinPortfolioConstructionProcessacrossallthe products. Was also involved in setting up certain key critical processes in the organization